The cryptocurrency landscape is a volatile and ever-evolving ecosystem. Predicting the future, especially in the realm of mining equipment, is akin to navigating a turbulent sea. However, by analyzing current trends and technological advancements, we can glimpse potential scenarios for 2025. If you’re contemplating investing in mining rigs or exploring hosting solutions, understanding these trends is paramount. Get ready for a wild ride through hashrates, ASICs, and the future of decentralized finance.

Bitcoin, the granddaddy of cryptocurrencies, continues to exert its influence. Its halving events, designed to curb inflation, directly impact miner profitability. As block rewards diminish, the efficiency of mining equipment becomes even more critical. Expect to see a renewed focus on ultra-efficient ASICs specifically designed for the SHA-256 algorithm, pushing the boundaries of power consumption and processing speed. The race for the most profitable Bitcoin mining rig will intensify, potentially leading to a consolidation of smaller mining operations in favor of large-scale, industrial farms. Forget about mining Bitcoin on your laptop; the future is about dedicated hardware and strategic energy consumption.

Ethereum’s transition to Proof-of-Stake (PoS) fundamentally changed the mining landscape for that specific coin. The days of GPU mining farms churning out ETH are over. However, this shift created opportunities elsewhere. Miners who once focused on Ethereum are now exploring alternative Proof-of-Work (PoW) coins. This has led to a surge in interest in coins like Ravencoin and Ethereum Classic, which remain mineable using GPU rigs. The demand for adaptable mining equipment capable of switching between different algorithms will likely increase. Miners need versatility to stay competitive in this dynamic market.

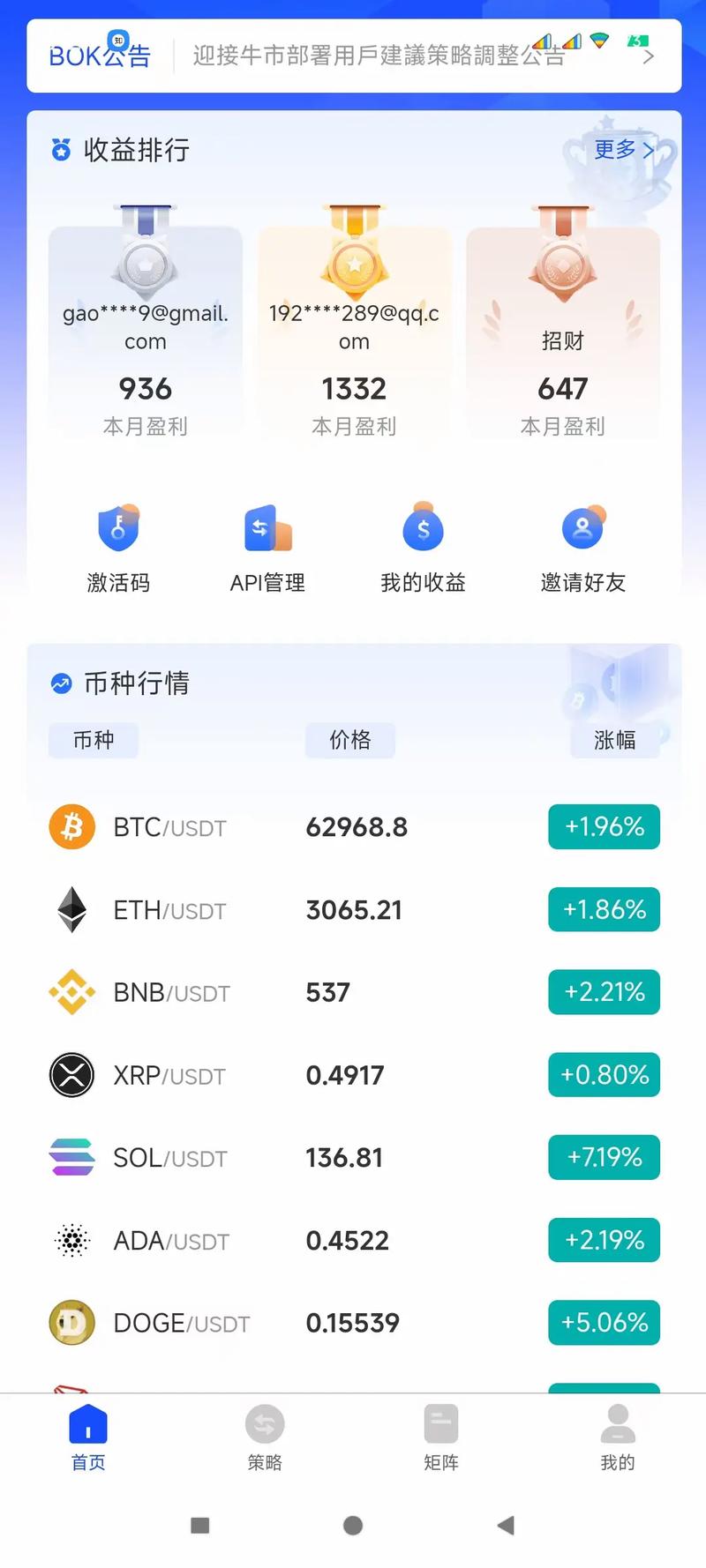

Beyond Bitcoin and Ethereum, a plethora of altcoins, some serious and some…less so, continue to compete for attention. Dogecoin, born as a meme, has demonstrated surprising staying power, fueled by social media hype and celebrity endorsements. While dedicated Dogecoin mining isn’t particularly common (it uses the Scrypt algorithm, often merged-mined with Litecoin), its price fluctuations can create short-term opportunities for savvy traders and miners who can quickly adapt their resources. Don’t underestimate the power of internet culture to influence the crypto market, even if the underlying technology isn’t groundbreaking.

The environmental impact of cryptocurrency mining remains a significant concern. Public pressure and regulatory scrutiny are forcing miners to seek sustainable energy sources. Expect to see a greater emphasis on renewable energy powered mining farms, utilizing solar, wind, and hydroelectric power. The future of mining is inextricably linked to its environmental footprint. Mining companies that embrace sustainability will be better positioned to thrive in the long term. Innovation in cooling technologies, reducing energy waste, and carbon offsetting will become increasingly important.

Hosting mining equipment in specialized facilities offers numerous advantages, including lower electricity costs, enhanced security, and professional management. As mining difficulty increases and equipment becomes more sophisticated, hosting solutions become increasingly attractive for both individual miners and larger operations. Look for hosting providers that offer competitive rates, reliable uptime, and advanced monitoring tools. Geographic location plays a crucial role, with regions offering cheap and abundant energy sources becoming prime destinations for mining farms.

The development of new mining hardware is a continuous arms race. ASICs are becoming more specialized and powerful, while GPU manufacturers are constantly improving the efficiency of their cards. The choice between ASICs and GPUs depends on the specific cryptocurrency being mined and the miner’s budget and expertise. ASICs offer superior performance for specific algorithms but lack the versatility of GPUs. GPUs can be used to mine a wider range of cryptocurrencies but are generally less efficient for Bitcoin mining.

The regulatory landscape surrounding cryptocurrency mining is still evolving. Governments around the world are grappling with how to regulate this nascent industry. Some countries are embracing mining, while others are imposing strict regulations or even outright bans. Miners need to stay informed about the legal and regulatory environment in their jurisdiction to avoid potential penalties. Compliance with regulations, including environmental standards and anti-money laundering (AML) laws, is becoming increasingly important.

Beyond the technological advancements and regulatory hurdles, the human element remains crucial. Skilled technicians are needed to maintain and repair mining equipment, optimize performance, and troubleshoot issues. The demand for experienced mining professionals will likely increase as the industry grows. Investing in training and education is essential for building a successful mining operation. The best hardware is useless without the expertise to operate it effectively.

In conclusion, the future of mining equipment in 2025 will be shaped by technological innovation, environmental concerns, regulatory developments, and the evolving cryptocurrency market. Staying informed, adapting to change, and embracing sustainability are key to success in this dynamic and challenging industry. Whether you’re a seasoned miner or just starting out, understanding these trends will help you make informed decisions and navigate the exciting world of cryptocurrency mining.

Leave a Reply